What to do by the end of the year to save on taxes and pay less on your next income statement

The year ends and with him your options to pay less taxes in the Income Declaration 2021. After December 31 you can only fill the IRPF 2021 well when the rental campaign arrives and your fiscal savings options will be much smaller.

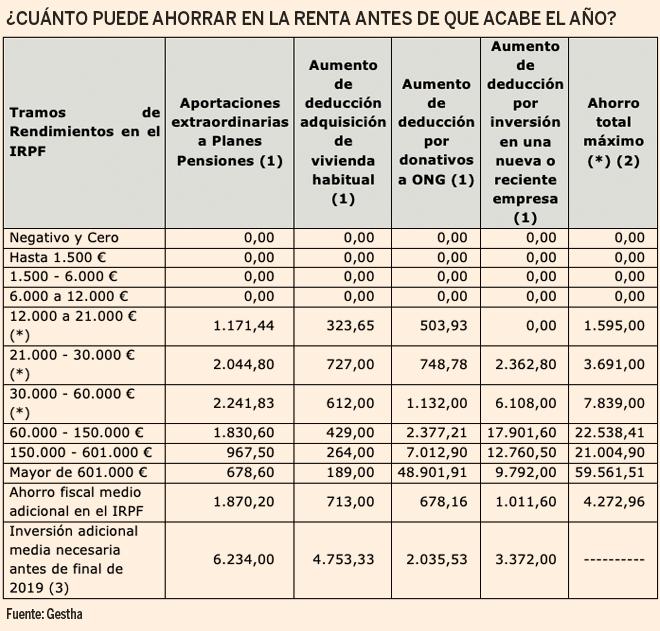

If you really want to pay less at IRPF 2021 there are 14 actions that will help you achieve it.The difference between putting them into practice exceeds 4,000 euros, which can stay in your pockets or end up in the Treasury, according to Gestha's calculations, the Ministry's technicians union.

These are the measures that you can start to pay less in rent 2021.

1- Take advantage of pension plans

GettyA classic to save taxes that in 2021 has seen its tax advantages cut.Specifically, the maximum investment for this year in individual pension plans is 2,000 euros and will be reduced to 1,500 euros in 2022.

This money can be added contributions to employment pension plans, which are the ones that companies open for their employees.The maximum contribution for this type of plans is 8,000 euros in 2021 and 8,500 euros in 2022.

Each euro that contributes to the pension plan will be subtracted from your taxable base, so it will be as if you had not admitted it.As an example, this would be the fiscal savings for contributions to the pension plan for a person with a salary of 16,000 euros, according to preahrory calculations.com

| Aportación | Tipo efectivo de IRPF tras la aportación | Ahorro total |

|---|---|---|

| 0 € | 8,96% | 0 € |

| 1.000 € | 7,64% | 212 € |

| 2.000 € | 6,45% | 402 € |

How to know if it compensates to contribute to your pension plan to deduct -

2- Improves the energy efficiency of your home

Getty ImagesAmong the tax novelties introduced by Royal Decree-Law 19/2021, of October 5, of urgent measures to boost the building rehabilitation activity in the context of the recovery, transformation and resilience plan is the deduction for works for the reduction ofthe demand for heating and cooling.

This deduction applies to the money invested from October 6 to reduce the consumption of heating and air conditioning by 7%.Thanks to it you can deduct 20% of the amounts you have paid on a maximum basis of 5,000 euros.

RD 19/2021 also includes two other additional deductions.The first is 40% for works for the improvement in non -renewable primary energy consumption on a maximum basis of 7,500 euros.In order to access it, the final energy rating of the house will have to be “A” or “B”.

The second is a deduction for energy rehabilitation works.The percentage to be deduced is 60% on a maximum basis of 5,000 euros and is applied in reforms that allow the expenditure of non -renewable energies to be reduced by 30% or that improve the energy rating of the building to the “A” or “B” class.

The three deductions are incompatible with each other when they are carried out in the same work and in all cases apply to payments made from October 6.

3- Mortiza part of the mortgage

GettyThe house is still a source of deduction beyond the works, but only for those who bought a house before 2013. In that case you can apply the deduction due to the acquisition of habitual housing, which is 15% on what you have paid as a mortgage plusassociated insurance on a base of 9,040 euros.

In total, you can deduct up to 1,350 euros according to the amount provided. For example, for a amortization of 3,500 euros, the deduction that you can include in your statement will be 525 euros.If you do not reach the maximum of 9,040 euros, you can amortize mortgage in advance to pay less taxes in rent 2021.

Remember that this amount is applied both in individual and joint declaration.That is, if you are married and the mortgage is in the name of the two conjugues, you can contribute 9,040 euros each with the right to deduction if you choose the individual statement.

Joint Income Declaration: What are the advantages and disadvantages

4- Apply exemptions in the sale of the house so as not to pay taxes

Susana Vera/Reuters

Gestha's technicians remember that there are three cases in which you will not have to pay taxes if you sell your home.

The first and the most common is when you reinvest the money for the sale of your usual home in the purchase of another house, which should also be your habitual residence.

The second is to use the money for the sale of the house to hire a life income.

Finally, if you are over 65 years old and the one you sell is your usual home, you will not have to pay taxes for it.

5- Remember works, taxes and expenses when selling your home

Getty images

What if you can't apply any exemption in the sale of the house?In that case you will have to pay between 19% and 26% for the patrimonial gain you get.That gain will be the difference between the sale price and the purchase price.

To adjust the figure, remember that you can add to the purchase price the taxes you pay when buying the house and the improvement works you have made.

Improvement or conservation works?The little difference that you are interested in knowing if you rent your floor

6- Business Angel beam and invests at Start Ups

Gataca

The investment in newly created companies allows to deduct up to 30% over a maximum of 60,000 euros, which places the maximum deduction at 18,000 euros.

To benefit from the deduction for investment in START UPS you must maintain the investment for at least 4 years and the company cannot quote in any market.

There is a state and an autonomous deduction that are incompatible with each other for the same amounts.

7- Compens losses and profits: Make losses or profits out

Getty ImagesFinance allows you to subtract the losses you have suffered in the stock market to the profits you accumulate.Thus, you can take advantage of your losses to pay less taxes and vice versa.

If in 2021 you accumulate several investments with benefits, you can undo investment positions where you are losing money to compensate with each other.It is what losses are called.

Thanks to this strategy you will save between 19% and 26% in taxes for these profits.

8- Before selling your actions, check your net yields

Getty

As a complement to the previous Council, you must take into account that if your income between investments and rental income exceeds 6,5000 euros, you will lose reduction due to work returns of 5,565 euros that apply to people with income below 16,825 euros.

9- Make donations to NGOs

No one without their daily ration

Donations to NGOs are deductible in IRPF provided that the entities are taken to Law 49/2002 of the tax regime of non -profit entities and fiscal incentives to patronage.

The amount you can deduce will depend on your contribution and the number of years you have been doing donations to the same NGO.

As a general rule, 80% of the first 150 euros donated and 35% of the amounts that exceed that amount.The percentage to be described ascends to 40% if, you have also donated the same money to that NGO for two years.

10- Applies reductions to work abroad

PixabayIf you have worked outside Spain for a company based abroad, you can apply an exemption of 60,100 euros to the money you have earned and pay less taxes.The main requirement is that in the country of destination there is a tax similar to IRPF.

What if teleworking for a foreign company?In this case you will not be able to enjoy the reduction, which only applies if you have lived outside Spain but tributes here.

Taxes and Teleworking: Should we pay the internet paid by the company?

11- Affiliate to a party or a professional college

Dani Duch/Pool via REUTERSAffiliation fees to political parties, federations, coalitions or group groups, allow 20% of 600 euros per year.

Similarly, you can also deduct the quotas of the Professional College in which you are discharged whenever necessary to carry out your work.

12- Transforms part of your salary into kind

ReutersA good trick to pay less in rent 2021 is to turn part of your salary into metallic into yields in kind, which may be exempt from paying.An example is health insurance when it is the company who hires them or education services.

13- Check the regional reductions

Pixabay

To the general deductions are added regional deductions, which are the most diverse.Two ideas to pay less thanks to them are to bring children to the nursery or advance the purchase of school supplies.Many autonomies reward these movements with deductions.

14- Do not forget the deductions as autonomous

GettyIf you work on your own account your options to save on rent 2021 go to maximize deductible expenses.One of the most powerful tools you have is to advance or delay investments to adjust your yields.

In the end, it is about taking advantage of these last two months to plan the 2021 income and pay less real taxes.

1595